The soil of Latin America stores enormous quantities of valuable mineral raw materials, necessary for the countries of the continent and for the world economy. The countries of South America have large tracts of land and forests. Some border seas rich in fish. In contrast to the material wealth of their nature, they occupy only the back end, as measured by the world’s economic progress. From a social point of view, their population is classified as poor.

The widespread view in the Western media world that raw material wealth generates overall prosperity hides the fact that for a long time profit has been directed only to Western lenders in the US and the EU. This is where value chains have shifted. The intention of the media is clear to distract from the causes of the delays. The economic inability of governments and corruption are to blame for misery.

Venezuela is currently the focus of media attention, with tendencies to hide the real links and defamation; of course, false news is never missing.

The former director of the Central Bank of Venezuela, D. F. Maza Zavala, in his non-fiction book Los mecanismos de dependencia – The mechanisms of dependency (published by the Fondo editorial Salvador de la Plaza) described the causes of backwardness as a set of mechanisms with long-term effects. With his analysis of the balance of payments and real processes, he shows that foreign banks, the International Monetary Fund (IMF) and Western transnational corporations (GE, GM, VW, Siemens, Monsanto, Odebrecht, etc.) are responsible. The roots of dependence are found in the colonial heritage. Today, it is the practices of neoliberalism that consolidate inequalities. The Monroe Doctrine of the United States sets the framework for modern cooperation.

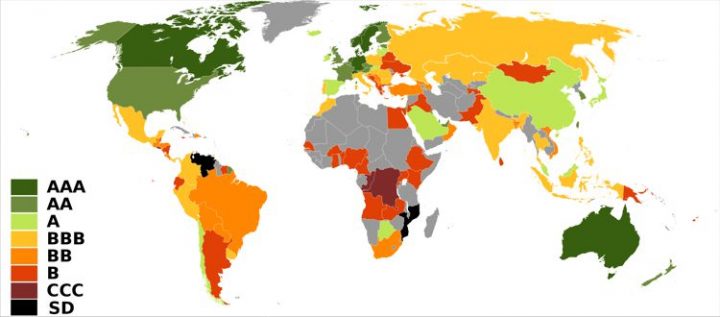

Zavala’s analyses over long periods of time show that there have been forced outflows of capital abroad. In the case of Venezuela, we find calculations of excessive interest for bank loans, constant payments of high technology rates, monopolized insurance and maritime transport services, among others. The negative balances of the balance of payments fluctuated between 280 and 300 million dollars annually, not including permanent cash outflows through relations with the parent companies and subsidiaries. Negative amounts had to be compensated annually with new high-interest loans. Interest rates were determined by the bank’s rating agencies. They have been in range C for years, and have been shown to be up to 18% per year. The consequences lead to a constant accumulation of country weakness. A more rapid industrialization of the country is prevented, as well as the creation of own sources of added value. In addition, there are very few financial resources left for health care, school education and research due to outflows.

Standard & Poor’s credit ratings (August 2018) | (Image: Iñaki Salazar via wikimedia commons | CC BY-SA 3.0)

Zavala lists seven other dependency mechanisms:

1. Judicial claims and access of transnational corporations to sources of raw materials, claims for the country’s participation in development costs, as well as tax exemption.

2. Use of standing loan applications to influence the national budgets of the Länder (requests for reprivatisation and reallocation of the budget at the expense of social tasks).

3. Public debt strategies as business models for Western banks and investors.

4. Credit monopolies, insurance monopolies and maritime transport services. Prevention of the integration of the economies of Latin American countries among themselves

6. Interdependencies with national capital groups as minor partners are used for lobbying networks, for subsidies to corporations, for subsidies and also for the formulation of laws. Advisory services and expert opinions for governments are obtained from fiscal coffers. Consultations addressing systemic issues did not lead to alternatives that fundamentally changed the economic situation.

7. Outward migration of the educated younger generation at the expense of the state, with negative consequences. There is a lack of experienced layers in technology and organization for the development of countries and of experts for economics and administration.

Since Presidents Bush, Obama and Trump assumed power, the mechanisms have been reinforced with sanctions and boycotts. The global banking network and the dollar network are used to prevent legitimate money transfers to Venezuela or Cuba. With the arbitrary classification of countries as a threat to the United States, the arsenal of legal means increases considerably.

The traditional military bases in Panama, Colombia, Brazil and Guantánamo in Cuba are seen as a threat. Fleet IV is active. Traditionally, the Organization of Latin American States (OAS) has been pressured by the United States to maintain the old system of dependency. The EU’s brothers in spirit and action defend the defence of dependency mechanisms.

Without changes in the mechanisms, it will be difficult for Latin America to achieve equality in the world economy. Unfortunately, opportunities are still very scarce. According to ECLAC, Venezuela depends on 92% of oil exports, Paraguay on 90% of agricultural exports and Chile on 63% of mining exports. Terms of trade are worsening to the detriment of Latin America.

In the mid-twentieth century, Nicaragua, Guatemala, Cuba, Peru and Chile tried to escape the mechanisms of exit and dependence on money. Mexico proposed a New World Economic Order (NIWO) to the UN at the same time. Mexico received support from the second (socialist) and third (non-aligned) world. The first world countries (formerly colonialist and now Western) stopped the historic Mexican alternative at the UN.

At the beginning of the 21st century, Hugo Chávez took advantage of the favourable conditions of high oil prices to open the door to the values of humanism, such as self-determination, equal rights and social human rights for all strata of Venezuela. The extreme resistance of the U.S. and its allies is being held back by all means of great power; the Western world sees its system in jeopardy. Venezuela has similar forces from the SAO PAULO FORUM countries that met in Caracas in July of the same year. The solidarity of Europe is limited, Russia and China are not only helping in the Security Council of the United Nations. A basic global demand is present: without external military intervention, global development needs alternatives to survival.

An alternative to dependency mechanisms, for example, is the ALBA Integration Alliance, founded in 2004 and open to all Latin American states. ALBA pursues non-profit cooperation among its members and in forms of solidarity economy. The first projects have been launched. The founding of BANCO SUR and the introduction of the SUCRE liquidation currency deprive the US of access to international money transfers and allow members to operate without accumulated cash reserves.

On the other hand, the EU agreement with MERCOSUR in 2019 hardly restricts dependency mechanisms.

Translation from Spanish Pressenza London