“British overseas territories win reprieve after threatening legal action or secession”. The Guardian reports that “The government has been accused of defying parliament by delaying plans to require British tax havens such as the British Virgin Islands to bring in public registers that reveal the true identity of owners of companies sheltering assets.

“Foreign Office ministers have caved in after a rebellion in the British overseas territories, including threats to take the government to court or even to secede from the UK. The British-administered tax shelters have always been seen as a blight on the Conservative claim to be fighting the multibillion-pound corruption industry…

“…The date means public registers in the overseas territories, seen as critical to winding down tax avoidance, will not be introduced until a decade after David Cameron first raised the issue as a flagship anti-corruption measure ahead of the UK chairmanship of the G7 industrialised economies.”

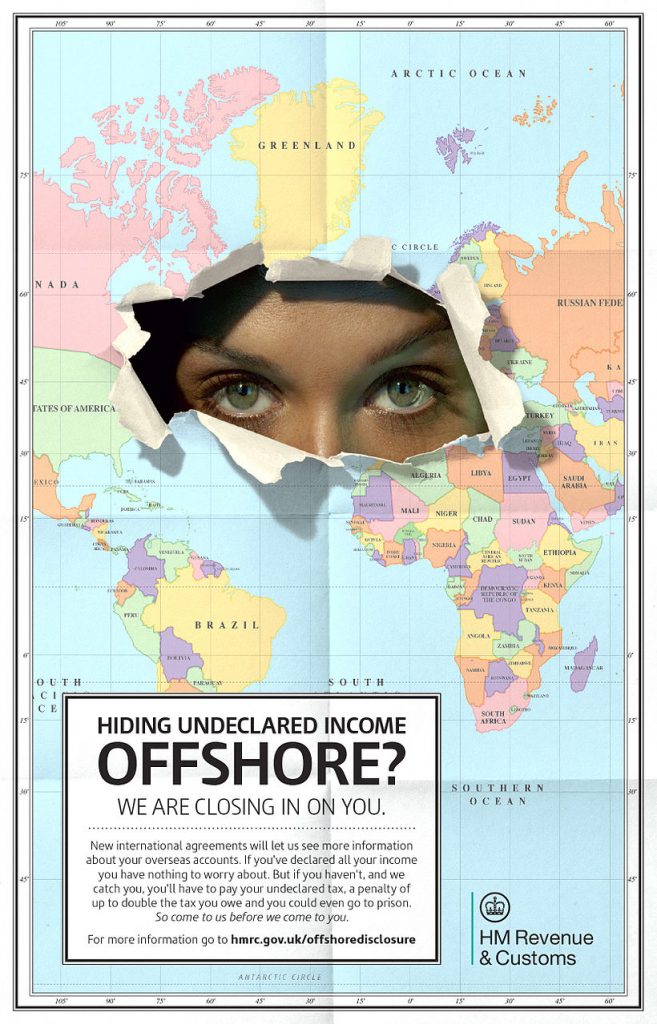

Examples of the way big companies take advantage of the tax brakes (we have already discussed how years of austerity and accumulation of wealth – a large part of which ends up in tax Havens – have created unspeakable poverty and inequality) are sometimes public, like Google moving to Bermuda £14billion in 2016 and £23billion in 2017, but most of the time the movement of assets remains a closely guarded secret. Nothing has really changed since the Panama Papers created more awareness about one of the most immoral practices of the neoliberal financial organisation.

Britain has done very well financially out of these “Treasure Islands”, these remnants of the British Empire, but the presence of other Tax Havens all over the world speak of an international order designed to dehumanise all but the tiny elite that makes the rules.

The electorate have the right to demand from their representatives that they resist this blackmail, this Trump-style tactics that promote tax avoidance and/or evasion and leave countries without the resources to share on the benefits of everyone’s work.