Rogue trader Nick Leeson told the South China Morning Post’s Eugene Henderson (SCMP, February 27, 2015) that there will be more financial scandals so long as people go unpunished. He was interviewed given his infamy as the ‘notorious’ stocks & shares trader on the occasion of the 20th anniversary of the collapse of Barings Bank. He says the ills of the financial sector are simply “not fixable”.

This story could immediately jump to Greece, where the new government is trying to lay down different ground rules, however, let’s tune in to what else Leeson told the paper… Despite numerous breaches of regulations and the global crash of 2007 Leeson is convinced many more scandals lie ahead.

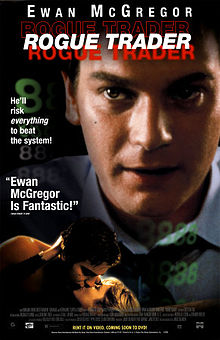

Speaking from tough experience this once junior derivatives trader who gambled and lost HK$ 9,935,000,000 and caused the 1995 collapse of Barings Bank and who came to be the embodiment of the flawed financial wheeler-dealer (Eugene’s words) claimed little of the “culture” that has brought shame on the financial sector in recent years has changed.

On a positive note he says that unlike the UK and USA, both Hong Kong and Singapore are better placed than other markets to avoid such wrongdoing as traders in these two big players among Asia’s banking communities are less likely to bend the rules as they will face the full force of law.

Leeson was quick to challenge attempts by HSBC chiefs to wash their hands of responsibility over accusations the bank help people evade tax. “The reality is if they can get away with it then some people will still do whatever they think will make them money,” he insisted, adding, “while people go unpunished it will happen again and again.”

So what has changed in the intervening years? “Quite simply the evidence suggests not a great deal,” he told the SCMP reporter.

“There’s a real contempt for the regulators in many countries and I think the problems within the sector, well, I just don’t think they’re fixable,” he concluded.

When he was working in banking there was always the possibility of reputation damage and risk. But that does not exist anymore. There are no consequences to people’s actions.

Last week HSBC group chief executive Stuart Gulliver and chairman Douglas Flint appeared in a public appearance in London to apologise for “unacceptable practices”. Gulliver claimed he could not know what everyone among the over 250,000 staff around the world were doing.

Leeson retorted: “He’s right, he can’t be held accountable for the actions of every member of staff across the world. But he is accountable for the culture within the organisation. Distain and contempt for the authorities is part of the culture.”