How can it be that when a country is in financial difficulty, “Market Forces” say that a country has to pay higher interest to borrow money? If there were any international solidarity a country should have to pay less interest when it is in financial difficulty, or even no interest, or at the very least it should pay the same as anyone else.

Taking the example of Greece, her bonds today were trading at 11.4% for a ten year bond, whereas German government bonds were trading at 0.31%.

Bonds are essentially loans. A country issues a bond (debt) and an investor buys it. The rate of interest is agreed by the “Market”. The investor gives their money to the bond issuer and the issuer uses the money for what they like, either it can be to finance long term development projects which might generate a profitable source of income, or it might be for short term needs, like paying salaries of public sector employees.

So, if Greece sells 10 million Euros of bonds today she will have to pay interest of 1,140,000 euros in interest for 1 year. Whereas Germany would pay interest of only 31,000 euros for the same amount!

Who pays the interest payments and the loan amount? Well, the tax payer of course.

Greece has huge debts due to years of financial mismanagement by a series of corrupt and useless governments. Everyone knew this was the case when the Euro was launched, including Germany, but nevertheless Greece was welcomed into the Eurozone. The corruption continued, the financial crisis arrived, Greece went bankrupt.

The troika (Germany) arrived and insisted that Greece has to pay its debts, to do this she has to reduce her running costs so that more money is available for debt repayment, but this has meant sacking as many public sector employees as possible: teachers, doctors, nurses, government building cleaners, etc. and removing public services such as health insurance and unemployment benefits. The ordinary people suffer, not the people who generated the debts in the first place because they have taken their money years ago to Swiss banks and off-shore tax-havens.

When all the public sector workers are unemployed, then all the private sector companies are also affected because there are less people with salaries to buy goods and services. So the private sector companies also sack huge numbers of people. More people suffer.

Less private sector employees equals less tax revenue for the government, and less money to repay existing debts and interest on bonds.

Austerity theory says that the economy of Greece will be able to grow only when people are prepared to take such low salaries and work for such long hours that industries from other countries will relocate to Greece and exploit this allowing them to make products as cheaply as possible, destroying Labour rights in the process and turning the workforce into de-facto slave labour.

Until that happens of course, there are no jobs and no jobs means that far fewer people are paying taxes, and in Greece tax-evasion was always high even before austerity arrived.

In the final twist of the sick paradox that is international finance, this means that the interest that has to be paid for bonds is much higher! Greece pays 37 times more than Germany does to borrow money in the example above from interest rates today.

Clearly the whole system sucks and is totally inhuman. When someone is in hard times surely any rational human being with any degree of empathy would say that solidarity means giving that person an easier situation until they can fully function?

To Germany the definition of solidarity is to continue lending more and more money at more extreme interest rates meaning that the country will never be able to get out of debt.

Possibly they are just waiting for the moment that a Greek government says, “You know what? We’ll just sell the country!” I wonder if €315 billion Euros (the estimated total of Greek Debt) is enough money to buy a whole country?

A humanist solution of course is not simple to implement but it is connected to the need to eliminate “Market Forces”.

What are they exactly? Well Market Forces basically means that Money is the most important value.

In international finance the goal is to make as much money as possible. When someone can’t afford to borrow money, they become desperate and agree to pay higher and higher interest because they have to pay their bills. They hope that somehow they will recover, earn more money one day, and pay the debt quickly.

What if we didn’t have Market Forces? What if human life was the central value? What would happen then?

Well, in the case of Greece, she has trouble paying back her debt, so you stop the interest payments, you stop generating more debt for the country. You allow the country to pay the bills that allow people to be healthy, educated and secure in society. You allow the country to invest internally and develop new sources of revenue so that more income will come from overseas. This allows the country to increase its tax revenues so that it can then pay its debts.

This is what would happen in a world based on the value of human life.

Market Forces are not natural. Interest on money isn’t natural. They don’t exist. They are abstract concepts conceived in the minds of, and maintained by, people who benefit from them.

In order to conquer Market Forces a new scale of values is needed. Money needs to be freely available, without interest, to those who need it, including countries.

In these days the Greek Prime Minister and Finance Minister are touring Europe looking for people who will listen with empathy to their situation. They are going around saying that they are willing to pay their debts. They want to be in a situation to pay back the money they’ve had to borrow! But they can’t do it under the conditions imposed by the troika. They can’t do it because they value human lives more than Market Forces.

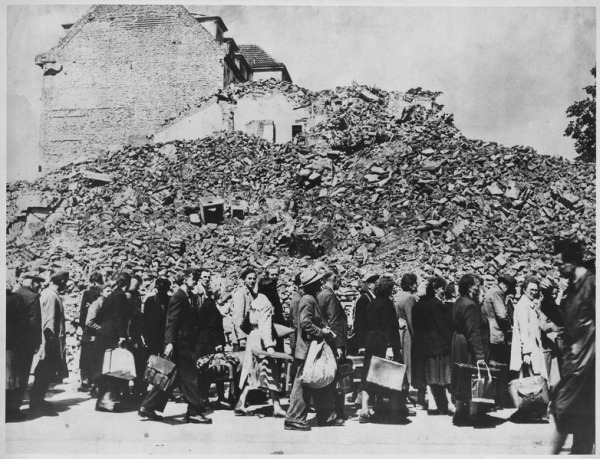

The solution is simple: stop piling more debt on Greece, allow her time to develop her infrastructure, allow industries to develop, allow new jobs to be created and stop charging huge rates of interest to borrow money. When Germany was devastated at the end of the Second World War, the Marshall Plan did something similar to allow recovery to happen.

Now is the time for a new Marshall plan for Greece.

Very symbolically, the first public act by the new Prime Minister was to go to a war memorial and pay homage to victims of German war crimes. The message is clear: Germany was devastated and a favourable plan was developed to allow recovery, Greece has been devastated, let’s give her time too to recover.