This is how Clive Menzies, political economist with a background in business and investment management, founder of the Critical Thinking research project at the Free University and member of the Occupy London Economics Working Group defines the Conference on Inclusive Capitalism in a BBC interview. The Conference, which has began today in London, counts on the participation of The Prince of Wales, former US President Bill Clinton, International Monetary Fund chief Christine Lagarde, and Bank of England governor Mark Carney. The interest is “To renew the capitalist system”.

Whilst some participants have expressed the need to adapt capitalism to prevent it from continuing to rise inequality and regulate better the banking system, but without changing its basic principles of competition and wealth creation (in fact wealth concentration) Clive Menzies points out some of the major basic flaws in the system:

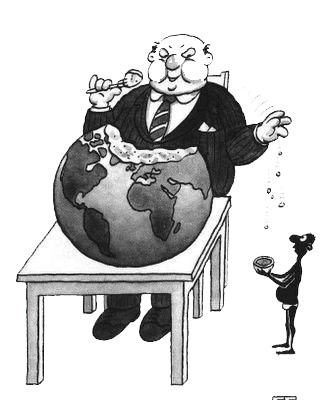

“A 2011 study in the New Scientist revealed that 147 “super entities” control 40% of 43,060 transnational corporations and 60% of their revenues. The study was based on shareholders and directors but doesn’t reveal beneficial ownership and control hidden behind nominee companies, trusts and foundations. Evidence suggests power is even more concentrated than the study indicates.

“This stateless power dominates politics, media and education. Financial capitalism seeks to monetise and control everything, influencing legislation and regulation in its favour.

“Stateless power is drawn from three fundamental flaws in the economic system, evolved to benefit the ruling class over centuries, but these flaws have been expunged from economic discourse:

“Flaw 1. Private capture of the value of land, resources and other commons (such as water, the radio spectrum, genes, nature and knowledge), gifts from nature (or God), the value of which is communally created. The value of these must be shared for the good of all to fund public services and an unconditional citizens dividend.

“Flaw 2. Interest on money creates no wealth but systemically drives inequality, environmental destruction, conflict and exponential, unsustainable debt growth. Debt must be unenforceable in law and usury (lending money at interest) illegal. Debt must revert to a social construct rather than its current role of facilitating wealth extraction, exploitation and oppression.

“Flaw 3. Increased mechanisation and technology has rendered full employment unachievable, unnecessary and undesirable. The means to life cannot be conditional on paid employment but is a right for all and must be provided in the form of an unconditional citizens dividend sufficient for a decent life.”

Christine Lagarde said at the Conference that “six years on from the deep financial crisis that engulfed the global economy, banks were resisting reform and still too focused on excessive risk taking to secure their bonuses at the expense of public trust…Borrowing from Oxfam research, she noted that the world’s richest 85 people, who could fit into a single London double-decker bus, control the same wealth as the poorest half of the global population of 3.5 billion people. … and that “options to address inequality include more progressive tax systems and greater use of property taxes” (The Guardian).

Whilst expressions of good intentions are always welcome, it is also important to note that borrowing the language of the critics of capitalism (a form of semantic violence, a “false flag” discourse) has become a strategy to present a more “benign” (and now “inclusive”) form of capitalism but without addressing any of the underlying mistaken assumptions which make it a system in need of radical change rather than more of the same but looking a little better.